What I was talking about is the idea of investing is less volatile areas. That is not "market timing", it's simply being a more conservative investor.

You miss my point. I am asking for justification for the premise that tilting ex-tech is a guaranteed win. If tech in 2024 is such a large part of the market/economy (unlike 1999) do we really think the other sectors are decoupled? Are we assuming that in a bubble popping recession ex-tech stocks (and value) will simply go down less?

Seems like market timing to me... and we know that that doesn't always work out well, even when 'everyone knows' something is going to happen.

Or at least I thought I heard that somewhere around here once.

I inherited some stocks from my father 12 years ago. They were very conservative investments generally, but in 12 years they have given good returns - Berkshire Hathaway (up 400%), Mondelez Intl (up 37%), General Mills (up 38%) and Edison Intl (up 93%). Sure if my dad had invested in software and chips maybe they would be even higher.

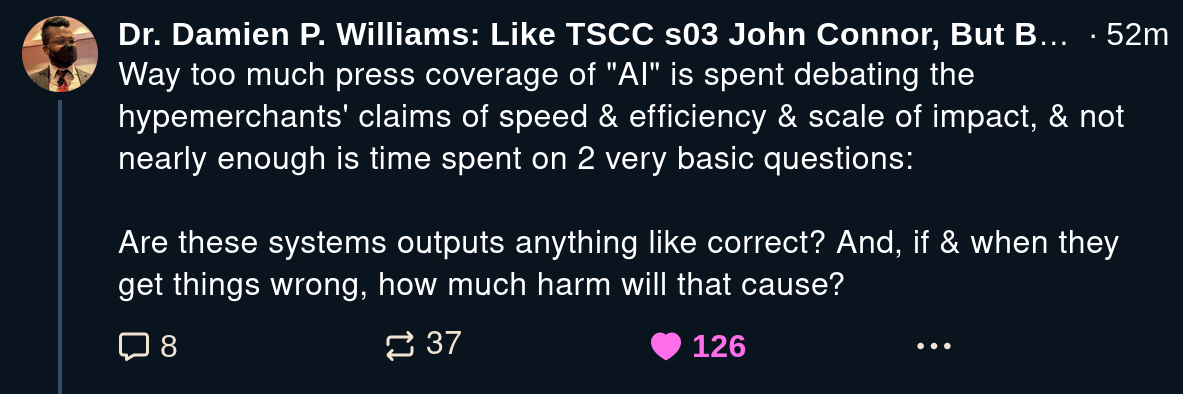

My problem with AI is that it is hyped, even though there have not been many applications so far that don't make a lot of mistakes.

Statistics: Posted by gitsy — Sun Aug 25, 2024 10:11 pm — Replies 86 — Views 9558