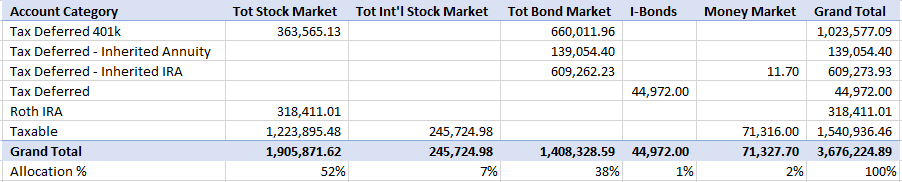

Thanks for all this feedback. I'll check out the links.to op:Planning to retire soon. Below is my portfolio as of a few months ago. It's now grown to around 3.8M. I'm 63 and I'll take SS at 70 and estimate I'll receive around 45k/year. No pension or additional income. For living expenses I need around 100k/year pretax. Planning to 100 though I suppose it's unlikely I'll live that long since both my parents died at 85-86.

Based on the modeling I've done with Firecalc and the Fidelity retirement planning tool, my portfolio could withstand a 50% equity crash. However I still worry there will be a crash just as I retire. So my thought is to move $200k out of Total Bond Fund in the Inherited IRA and into something short term like treasuries or CDs. If I run this change through the retirement modeling tools, it doesn't seem to have much impact on the success of my plan. So maybe I should just do it to my reduce anxiety. I saw in some other post where Klangfool said he keeps 2-3 years expenses available in cash. I don't have an easy way to do this right now in my taxable account without creating a capital gains tax liability since I'm still working and in a high income bracket. I'd appreciate anyone's thoughts.

Here are some considerations and questions?

1

As you have no pension or other income streams in retirement beyond SS, yes, you are vulnerable to SORR and other portfolio dangers since you are dependent on it to cover all of your retirement expenses.

2

While 3.8 million with 100k/yr in yearly epenses in retirement, less SS at age 70, your annual expenses are 55k/yr. You will have a gap year coverage until age 70, so 7 years at 100k/year. Based on the very rough 4% Withdrawal rate, that's 38X. Correct?

3

a)

SORR is a concern. There is SORR from market based volatility. IE: Imagine May 2020 when the market dropped over 30 percent in 30 days.

b)

But, there's also SORR where a portfolio sustains large "lumpy" spending depletions that are unrecoverable IE: Health or other life trauma (imagine needing 100's/k's of dollars to cover health care or health emergency expenses), needing to sell a home and relocate at high cost, family trauma, etc, or other life "Black swans" and "perfect storms".

c)

What would happen if both "a" and "b" happened at once and over a period of several or more years?

(I experienced this in the retirement transition, also no pension, etc. The danger is real).

4

Consider a percentage of allocation from your "bond fund (s) or bond like side of your portfolio in:

CD Ladders (new issue) and/or Treasury Ladders (new issue, not funds) as a buffer (in addition to your overall allocation) to SORR, etc.

You have you considered this and it is an excellent idea "for you". At retirement expenses of 100k/year before age 70, and potential "lumpy expenses", maybe more than 200k??

(dis laimer: What others might do is moot, others with pensions and other income streams in retirement that cover expenses have different needs and concerns).

5

What is your overall allocation now?

What overall allocation are you planning for retirement?

6

Are you health insurance needs covered?

7

Have you considered that overall portfolio allocation is also a moderator for "investing behavior pitfalls"?

More unrecoverable damage can be done to a retirement portfolio by investor behavior than market behavior.

Read:

Investing Behavior Pitfalls

https://www.bogleheads.org/wiki/Behavioral_pitfalls

To op:

Read:

SEQUENCE OF RETURNS RISK

This is an excellent thread that addresses the "Retirement Red Zone".

Sequence of Returns Risk by "DonCamillo".

viewtopic.php?t=159107

Kitces "Retirement Red Zone"

https://www.kitces.com/blog/managing-po ... -red-zone/

Read:

"Ages of the Investor: Life Cycle Investing", by W. Bernstein.

Softcover: Amazon.com

https://www.amazon.com/Ages-Investor-Cr ... 140&sr=8-1

to op:

I hope these random considerations are helpful to you.

I had similar concerns when I early retired at 58 and based my responses on that as well.

** Even with 100X in retirement, "anxiety" is real. If having a certain portfolio structure helps your "sleep factor", then that is "right" "for you".

dis laimer: zillions of ways to things and thoughts on things. This is only one to help the OP.

Statistics: Posted by catchinup — Sat Aug 17, 2024 8:20 pm — Replies 49 — Views 4491