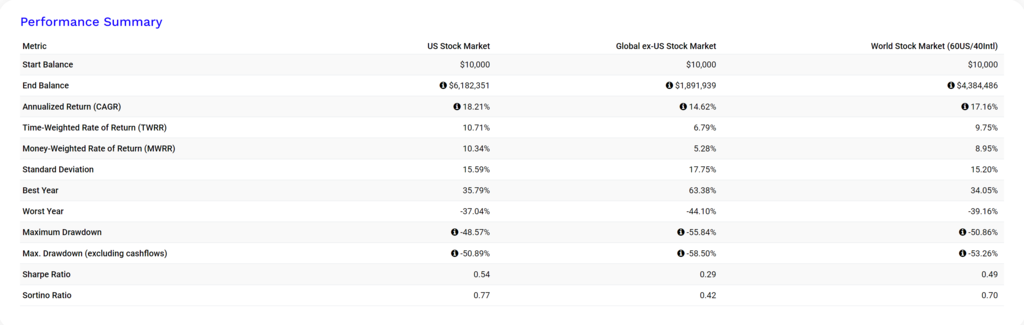

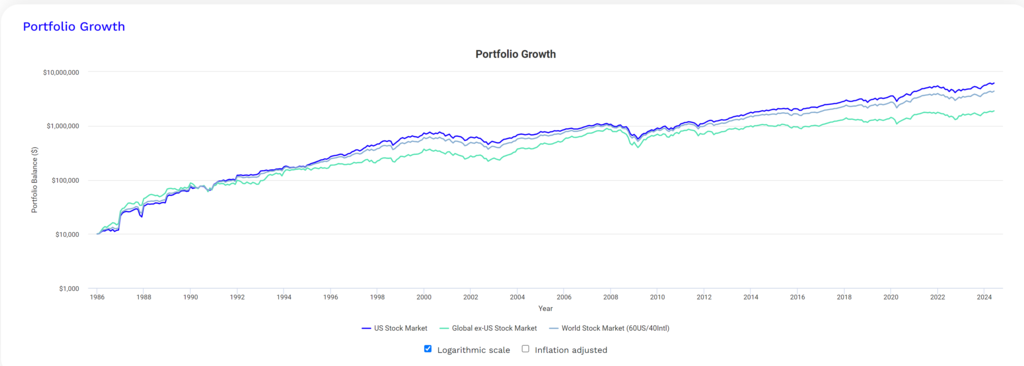

The world stock index is the weighted average of the US stock and Global ex-US stock market. I'll use the term International to refer to Global ex-US stock market. If the world stock index is the average of the two, I expect that some years the US stock index would be greater than World stock and in some other years the International index would be greater than World stock. To assess this, I compared 3 asset allocations. I used a 10K annual investment adjusted for inflation

1. US Stock

2. International stock (Global ex-US)

3. World Stock

For World stock, portfolio visualizer did not have a world stock index. I used a 60-40 US/Intl split as an approximation. Following are the results of the comparison from 1986 to now.

![Image]()

![Image]()

Observations

1. Barring a few initial years (1986 to 1991), the US stock was greater than the average for this duration.

2. The outperformance of the US stock to the average was about 1% CAGR.

Questions

1. Should I read this as the US stock market has consistently been greater than the average in the duration selected?

2. What factors contributed to the US out performance over international during this period? Do we expect those factors to continue in the future.

3. Would this chart look different if I chose different starting years?

4. I have used a 60/40 US to international allocation. Is that a good approximation? I would like to compute the actual returns using the weighted average of the two indexes. Can someone point me to a tool or approach to do that?

1. US Stock

2. International stock (Global ex-US)

3. World Stock

For World stock, portfolio visualizer did not have a world stock index. I used a 60-40 US/Intl split as an approximation. Following are the results of the comparison from 1986 to now.

Observations

1. Barring a few initial years (1986 to 1991), the US stock was greater than the average for this duration.

2. The outperformance of the US stock to the average was about 1% CAGR.

Questions

1. Should I read this as the US stock market has consistently been greater than the average in the duration selected?

2. What factors contributed to the US out performance over international during this period? Do we expect those factors to continue in the future.

3. Would this chart look different if I chose different starting years?

4. I have used a 60/40 US to international allocation. Is that a good approximation? I would like to compute the actual returns using the weighted average of the two indexes. Can someone point me to a tool or approach to do that?

Statistics: Posted by long-term-investor — Sun Jun 30, 2024 8:34 am — Replies 0 — Views 31