Grabiner,It doesn't make sense to use a target-date fund when you have a large taxable account. The advantage of the target-date fund is that it keeps the right allocation for you, but it doesn't do that if you have other accounts which do not hold balanced funds. If the stock market rises, you will have too much stock, and you won't want to sell stock in your taxable account; you would have to give up the simplicity of the target-date fund by selling some of it to buy bonds in order to avoid this.

Thus, it's better to choose your target allocation first, and then choose the most tax-efficient way to implement it.

Regarding Target funds, Your points are well taken.

My Target funds are in IRA and I sell them as minimum on need basis to rebalance to AA.

Grabiner,As long as you are in a high tax bracket in CA, you pay a very high tax rate on qualified dividends (20% federal + 3.8% NIIT + 9.3% CA = 32.1%). Therefore, you should prefer CA munis in your taxable account over stocks, as you pay no more tax cost than anyone else on munis, but twice as much as most investors on stocks. For inflation protection, max out I-Bonds in preference to TIPS, since you can postpone the interest on the I-Bonds until you redeem them in a lower bracket.

The next choice would be US stocks, as they have lower dividend yields than foreign stocks, and more qualified dividends; the tax reduction is more than the foreign tax credit at your tax rate.

Holding those should allow you to hold all your TIPS and foreign stocks in your IRA.

Regarding Muni, I also like your points about tax efficiency in high tax rates.

Regarding I-Bond I also appreciate you telling me about it, especially tax will be deferred. Unfortunately I can only buy $30K/year, so to build the bridge, I need to buy it in 5 years sequentially and won't be as high performer as the TIPS ladder. I also need to swap with new series as mine fixed rate was zero. I have few chances and perhaps use hybrid TIPS and I-Bond.

When stock gains in my taxable account, I haven't had issues because I bring new money once in a while in the next 5 years.

Fortunately I have balanced a taxable account recently with adding more to international and bonds without any selling.

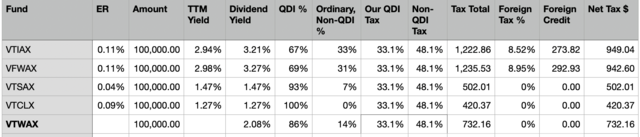

I have done some tax calculations comparing (VTCLX, VTSAX) tax-managed US stocks and US stocks index, and

(VFWAX, VTIAX) international funds. Thanks to bogleheads. (Please see below)

These numbers are matching with your assertions. Correct me if not right:

* INTL should be in IRA along with TIPS

* US Stocks second to Muni should be in a Taxable account.

Unfortunately I have both types of stock and Muni, and not all Muni in a Taxable account. Selling stocks causes a tax event.

Let me understand your points:

Assuming the taxable account has a total of T, and IRA total is T'.

You are saying optimal allocation for tax efficiency is as follows.

Taxable Acct:

100%T in Muni, stock=0

IRA:

US Stock=0, Int'l = 60% T+ 60% T'

Bond=40% T' - 60% T

OR you meant to achieve better performance and less efficiently tax-wise:

Taxable Acct:

US Stock=36%T, Int'l stock = 0, Muni=40%T

IRA:

US Stock=0, Int'l stock=60%T' + 24% T , Bond=40%T'

I'm thinking this allocation may not perform better, because:

1) taxable account total amount (T) might not be the same as IRA (T').

2) Performance of US stock won't be the same as Int'l stock.

Following data shows current allocation is better than most tax efficient. Plus :

VFWAX tax - VTCLX tax= ($942-$420)/$100K=0.52% (Edited: which look little but it's not)

Example Performance Comparison

I assumed current 5Y performance :

US stock(VTCLX) = 12.4%, Int'l Stock(VFWAX)=5.33%, Muni: 1.96%

Optimal or Case 1:

Taxable Acct:

100%T in Muni, stock=0

IRA:

US Stock=0, Int'l = 60% (T+T')

Bond=40% T' - 60% T

Case 2:

Taxable Acct:

US Stock=36%T, Int'l stock = 0, Muni=40%T

IRA:

US Stock=0, Int'l stock=60%T' + 24% T , Bond=40%T'

Case 3: my current allocation:

Taxable Acct:

US Stock=36%T, Int'l stock = 24%T, Muni=40%T

IRA:

US Stock=36%, Int'l stock=24%T', Bond=40%T'

$perf 1= (100%T * 1.96% + 60%(T+T') * 5.33%) = 3.26%T + 3.20%T'

$perf2 = (36%T * 12.4% + 40%T * 1.96% + (60%*T' + 24%T) * 5.33% + 40%T' *1.96% = 6.53% T + 3.98% T'

$perf 3 = 36%(T+T')*12.4% + 24%(T+T')*5.33% + 40%(T+T')*1.96% =

4.46%(T+T') + 1.27%(T+T') + 0.78% (T+ T') = 6.51% T + 6.51%T'

$perf2 - $perf 1 = 3.27%T + 0.78%T'

$perf3 - $perf1 = 3.25%T + 3.31%T'

So :

perf2 > perf1(optimal tax efficient), and

perf3 > perf1 and perf 2

approx. perf = 6.25%(T+T')/(T+T')= 6.25% annually

assuming n = (T+T')/100K

tax difference for stocks=0.52%/100K * 60% * n = 0.312% * n

performance gain = 6.25% (T+T')/(T+T') = 6.25%

When n = 6.25%/0.312n = 20.02, then the portfolio is about $2M

more than $2M tax takes over.

What you think?

Thanks.

------------- Read if you are interested ------------------------------

Compare funds taxes

I used TTM Yield and normalized dividend yield.

Assumed dividend yield = TTM Yield/(1-foreign credit%). Let me know if this is incorrect.

Tax amount = Amount fund * Dividend Yield * [(QDI % + QDI tax) + (Non-QDI * Non-QDI Tax)]

Foreign Credit = Dividend Yield * (Tax Credit %)

Net Tax = Tax amount - Foreign Credit

Here are results for a $100K investment.

Statistics: Posted by marginal — Fri Dec 29, 2023 1:47 am — Replies 6 — Views 895